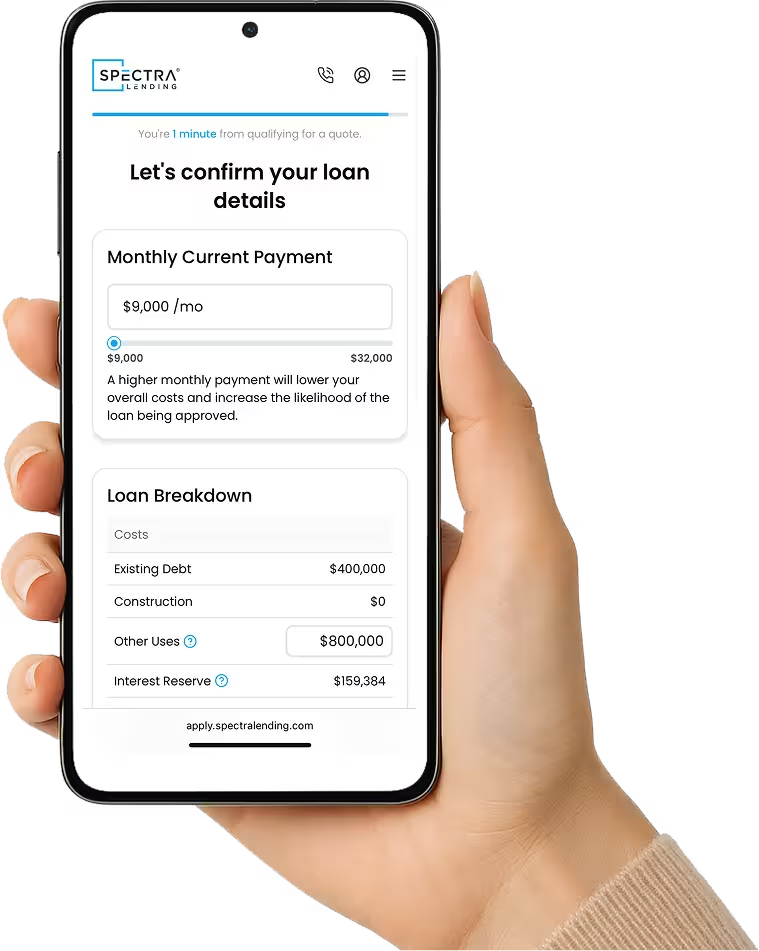

Commercial Loans, Simplified.

Securing capital shouldn't take months. Commercial real estate and small business loans delivered in days.

Commercial Financing Made Simple.

Spectra Lending provides clear, fast, and transparent lending options designed to help borrowers move forward with confidence.

- Stalled projects, distressed assets, time-sensitive deals

- Financing from $1M to $20M

- Rapid funding in as little as 5-14 days

- Cut your monthly payments by up to 70%

- Financing up to $500K, in as little as 1-3 business days

- 1-36 month terms, 10-year amort. schedule

Direct Lending. Real Solutions. Fast Decisions.

Spectra Lending provides clear, fast, and transparent lending options designed to help borrowers move forward with confidence.

Capital Without Complications

Why business professionals choose Spectra Lending

While many of my communications with lending partners involve long, drawn-out emails that can stretch over multiple days, I know I can immediately pick up on the phone and call Landon with a potential deal. We can discuss the nature of any project and reach a resolution on its attractiveness as a fit almost instantaneously.

Spectra Lending played a critical role in helping our client secure $2,560,000 to refinance two Dollar General locations in New Jersey that were in default. Their expertise, speed, and professionalism made all the difference in getting the deal done.

As a repeat borrower my experience with Spectra Lending has been outstanding. Their team is knowledgeable and professional and know how to get deals done - and done quickly. Their post-closing service is just as impressive.

Nationwide Coverage

We provide flexible and reliable lending solutions across 39+ states, as well as in Puerto Rico and the U.S. Virgin Islands, giving borrowers broad access to capital while adhering to specific state regulations and eligibility requirements where applicable.

Funding Made Simple, Growth Made Possible

We've modernized the lending experience to support your momentum. Apply in minutes, upload documents securely, and move through approval and closing with ease—so your business can grow without interruption.