Business Term Loans, Simplified.

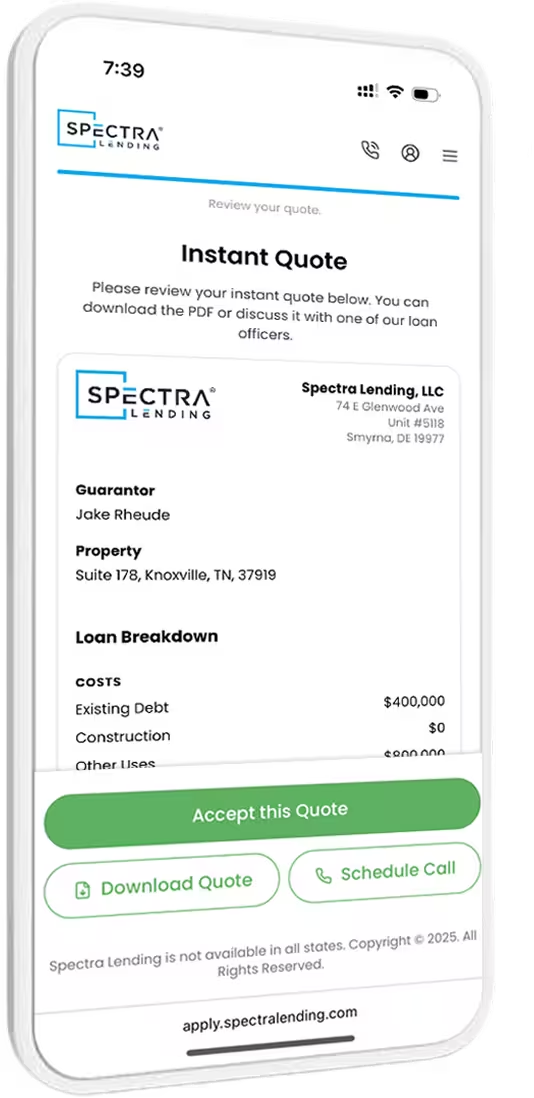

$50K to $500K term loans. Apply in minutes, get funded in as little as three days.

Built to Reduce Payments & Restore Cash Flow

Spectra's Growth Term Loan uses a long-term amortization structure that can reduce monthly payments by up to 70% compared to short-term products, giving businesses predictable monthly payments and room to grow.

- 10-Year Amortization

- Up to 36-Month Repayment Term

- Fixed Monthly Payments

- Designed for Cash-Flow Stability

- Business is burdened by MCA or short-term debt

- Operators struggling with unpredictable cash outflows

- Companies that need capital without straining monthly cash flow

Business Funding Made Simple

We've simplified the lending process by removing the hurdles of traditional paperwork. Get pre-approved instantly and follow our clear path to closing so you can focus on growing your business without interruption.

Proven Partners in Business Financing

Transparent terms, responsive service, and a lending team that understands how businesses grow.

What Can a Business Loan From Spectra Be Used For?

Transparent terms, responsive service, and a lending team that understands how businesses grow.

Capital Without Complications

Why business operators choose Spectra

While many of my communications with lending partners involve long, drawn-out emails that can stretch over multiple days, I know I can immediately pick up on the phone and call Landon with a potential deal. We can discuss the nature of any project and reach a resolution on its attractiveness as a fit almost instantaneously.

Spectra Lending played a critical role in helping our client secure $2,560,000 to refinance two Dollar General locations in New Jersey that were in default. Their expertise, speed, and professionalism made all the difference in getting the deal done.

As a repeat borrower my experience with Spectra Lending has been outstanding. Their team is knowledgeable and professional and know how to get deals done - and done quickly. Their post-closing service is just as impressive.